Advice for International Amazon Japan Sellers regarding the Consumption Tax update on October 1st 2019.

Key points of Tax Changes for Amazon Sellers in Japan

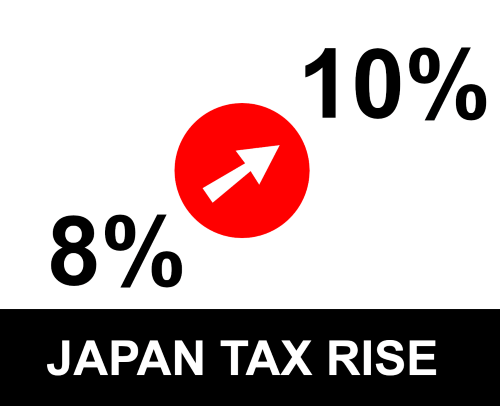

Japan is changing the rules around consumption tax on 1st October 2019.

Amazon Japan have been sending out email reminders via seller-central about how it affects sellers on Amazon Japan and what action they need to take.

Here is the email in full (click to enlarge):

What is happening?

Consumption Tax (like VAT / Sales Tax) is increasing from 8% to 10% for most categories of products.

What do I need to do?

Probably nothing. Just be aware that when you send a batch of inventory to Japan next time you will pay 2% more in your tax charges.

What categories does the tax rise affect?

All categories of products except the following:

- Food & (non-alcoholic) drinks – These are staying at 8% and is called reduced rate.

- Some nursing care goods/ wheelchairs – These are going to be 0%

Here are the full rules in the help section of seller-central:

https://sellercentral.amazon.co.jp/gp/help/help.html?itemID=GJYN3ND6A829Z5AM

Click to enlarge the image:

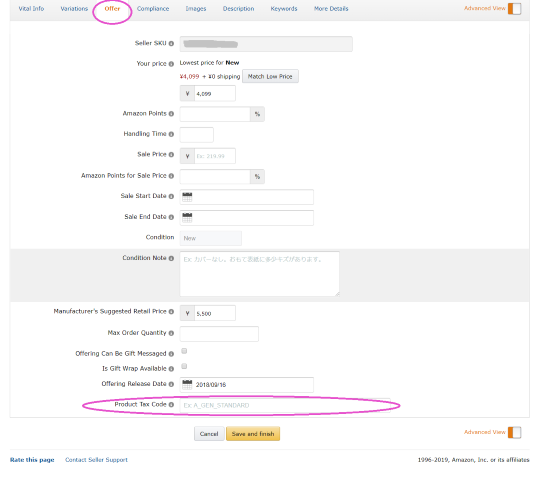

Amazon mention about updating tax settings for my products – What do they mean?

You probably don’t need to do anything as products get the default code automatically. If you want to check a product’s tax code you’ll need to go into your inventory management and view the offer tab. A detailed explanation is here: https://sellercentral.amazon.co.jp/gp/help/G8E67JPEXAPQ4672/

Click to enlarge the image:

How am I currently paying tax as an international Amazon seller in Japan?

You pay at the point your inventory is imported into Japan. It’s usually handled by your shipping company.

Here is our general article on Tax requirements for overseas Amazon sellers in Japan

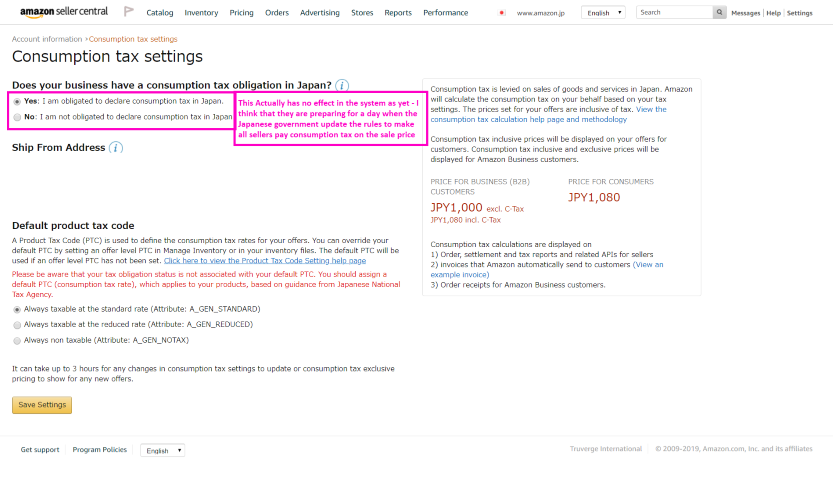

Amazon mention about updating my account tax settings – What do they mean?

Your account has an account level default tax code which is applied to all products if you don’t set them at individual product level. You probably don’t need to do anything as products are set at the default rate automatically. If you want to check your settings then here is where it is:

https://sellercentral.amazon.co.jp/tax/jpenrollment/home

Click to enlarge the image:

Conclusion

As an international seller, you probably don’t need to do anything other than be aware of what’s happening. And plan your pricing strategy the next time you send inventory to Japan to take account of the increase.

WE SPECIALIZE IN:

- Amazon Japan Listing Creation & Optimizations

- Amazon Japan Advertising

Our goal is to help brands launch and grow sales on Amazon Japan.

PRICING SUMMARY

We want to make our pricing as clear and simple as possible, which is why we have fixed fees rather than complex commission based pricing or contact us for a quote links.

NEW LISTING SETUP OR OPTIMIZATION

$449 per product type + $30 for any additional variation

UNBOXING/ EXPLAINER VIDEO/ VOICE-OVER VIDEOS

$199 per video

ACCOUNT & ADVERTISING MANAGEMENT

From just $799/month or 5% of revenue

AMAZON JAPAN LISTINGS

LISTING CREATION / OPTIMIZATION PRICING

$449 per product type (Parent ASIN) + $30 for any additional variation (Child ASIN)

EXAMPLE PRICING CALCULATION

10 x product types with each product type having 3 colour variations.

- 30 products in total, 20 of which are classed as Child variations and 10 are classed as Parents

- (10 x $449) + (20 x $30) = $5090

Having a well written and keyword rich product listing is essential because:

- Shoppers need to be able to find your product on Amazon Japan.

- When they do find you product they then need to have confidence so they buy.

See a finished result for one of our clients on Amazon Japan - https://www.amazon.co.jp/dp/product/B08RS5MKW5

This was quite a complex project with a lot of size and type child variations. But the effort was definitely worth it.

The Rising Sun Commerce Amazon Japan Product Listing Process:

We gather all the information needed to fully understand your product and brand. We need to understand your products' features and benefits in fine detail so that we can hone the copy of your listing. We can use your English Amazon listings as a guide, however Amazon Japan is VERY strict in the wording you can use and often your English listings would be rejected instantly.

2.

We conduct detailed keyword research using specialist software such as Helium10’s Cerebro tool to analyze the keywords used by your main competitors on Amazon Japan. We also use Amazon’s own Brand Analytics data to ensure we pull out all of the most important keywords. Finally, we manually read over your competitors listings to pick out common keywords.

3.

Our optimally written product listings are professionally translated by one of Rising Sun Commerce’s experienced native Japanese listing editors who carefully integrate the keywords from the extensive keyword research process as they translate your product listings - check out Shiori’s short video where she discusses a client's listing here.

4.

We annotate any text in your images into Japanese, because everyone knows that the images are one of the most important aspects of your Amazon Product Detail Page.

5.

We construct an upload (AKA flat) file and upload your listings to Amazon Japan. We complete as many fields as possible in the flat file to help with Amazon indexing and categorisation. We apply any keywords that are not integrated into the product listing into the Generic Search Terms (AKA back end search terms). Uploading the flat files to your Amazon Japan account can sometimes be a smooth process, but due to Japan’s quirks and glitches this can often be a bumpy process. We guarantee that your product listings will be uploaded to Amazon Japan, even if it takes multiple Seller Support cases and multiple revisions to remove and replace text or images to satisfy the Amazon Japan gods.

6.

We upload your Japanese specific images to Amazon Japan. This can be a complex process and often requires multiple attempts and Seller Support cases. It also requires Brand Registry access so there is additional admin required.

7.

Any appropriate listing videos will be annotated and/ or a voice over will be applied at no extra cost. The videos will be uploaded to your listings.

8.

Using your English A+ content as a guide we construct and upload A+ content for your product listings. Like the Product Detail Pages this can often be a tough process because Amazon Japan are irrationally picky about the words you can use. We have a database of banned words and phrases, but we are still surprised by Amazon when they pick up on a new term. Again, we guarantee your A+ content will be uploaded to Amazon Japan, no matter how long it takes.

9.

Finally, once the listing has been on Amazon Japan for a few days we do Keyword Index Checks to make sure the listings are correctly indexed.

The video below show how we make sure your products are fully indexed on Amazon Japan.

JAPANESE UNBOXING & VOICE-OVER VIDEOS

Using one of our trusted native Japanese creators we can commission custom unboxing videos for your products.

We ensure the creators discuss the main benefits and features of your product.

Alternatively, if you have a good promotional video in English, we can replace the English voice with a professional standard Japanese voice.

Having a video on your Amazon Japan product listing is a major benefit and helps show the shopper exactly what they will get and reinforces the main product selling points.

$199 per video