Taxes for Overseas Sellers on Amazon Japan

Expanding your reach by selling on Amazon Japan is a no-brainer.

However, Japanese tax regulations and laws can be a bit of a minefield. Finding the information you need as a foreign overseas seller is extremely difficult.

Confusion over Japanese tax laws is one of the major stumbling blocks (along with understanding the language) for overseas sellers on Amazon Japan. We’ve dug deep and gathered all the information we could find to help you out. Read this updated post about Amazon taxes in Japan.

Tax laws and regulations in Japan

Let me begin by saying that I am not a legal tax representative or Japanese tax agent. All information presented here is based

A full reference list can be found here [at the end of this article]

NOTE: We are experts in selling on Amazon and

What experience do we have? We (Rising Sun Commerce) have imported goods into Japan using sea freight, submitted all necessary paperwork and paid all taxes and duties to get these goods through Japanese customs. We have delivered goods to Amazon warehouses in Japan and sold them via FBA (Fulfillment by Amazon) (read our case study here). We have also sold as Merchant Fulfilled and shipped individual products from the UK to Japan via traditional methods (i.e. using the Post Office).

There are two main tax areas to consider when shipping and selling in Japan. One is when you import goods

Japan import tax [AKA Consumption tax] and import duty

When you import your products to Japan they require the necessary paperwork in order to pass through customs and to calculate the import taxes and duty. This includes:

When you import your products to Japan they require the necessary paperwork in order to pass through customs and to calculate the import taxes and duty. This includes:

- Bill of Lading (details needed to process the freight shipment and invoice)

- Packing List (what is being shipped, quantity, weight, volume)

- Commercial Invoice (value of the goods)

Your freight company will be able to help you out with all of these documents. A full list of requirements for importing into Japan can be found here (8).

You also need to pay import taxes and duty (plus in some cases other internal taxes [9]).

Import Tax [Consumption Tax] in Japan

Consumption Tax must be paid when your goods pass through customs in Japan, unless their value us under 10,000 Yen (approximately £70 or $90

Again, this is something your shipping company can normally handle for you;

Import Duty

For your goods to pass through customs you also need to pay import duty. This is worked out as a % of the customs value of your goods. It can range from 0% to 30%, but as

-

- Alcoholic Beverages

– Wine: 70 yen/l

– Some of

– Sake, Some of

- Tomato Ketchup, Ice Cream, Dropped

furskins , Article of apparel, etc.: 20% - Coffee, Tea excluding Black Tea, Gelatine, Clues, Tanned or Dressed

furskins excluding Droppedfurskins , etc.: 15% - Vegetables and fruits for food, Seaweeds, etc.: 10%

- Tableware, Furniture, Toys, Games, etc.: 3%

- Rubber, Paper, etc.: Free

- Other Products: 5%.

Again, your shipping company can normally arrange the import duty to be paid, but they will need to know the correct category for your product in order to pay the correct duty costs. For

Taxes on Sales on Amazon Japan

The most confusion when it comes to taxes in Japan is that of sales tax. This is especially true for foreign sellers who have a company overseas but store their products in Japan (Point of Sale in Japan) and sell to Japanese people, as you do when you use FBA in Japan.

The most confusion when it comes to taxes in Japan is that of sales tax. This is especially true for foreign sellers who have a company overseas but store their products in Japan (Point of Sale in Japan) and sell to Japanese people, as you do when you use FBA in Japan.

The confusion lies in whether or not you need to

What if you self-fulfill your Amazon orders to Japan?

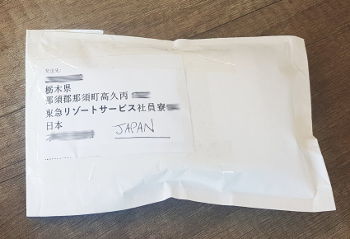

If you sell on Amazon Japan but post your orders directly from another country (Merchant Fulfilment on Amazon Japan) then you do not need to worry about consumption taxes (both on imports or on sales) or import duties (4). See the process of posting something to Japan from the UK here.

If you sell on Amazon Japan but post your orders directly from another country (Merchant Fulfilment on Amazon Japan) then you do not need to worry about consumption taxes (both on imports or on sales) or import duties (4). See the process of posting something to Japan from the UK here.

Any products under 10,000 Yen (approximately £70 or $90

Do Amazon Japan sellers pay Consumption Tax on sales?

As of 2021 this section is out of date.

As of 2021 this section is out of date.

From our research (1-24) it appears that if you store your products in Japan (i.e. in an Amazon warehouse in Japan) and sell to Japanese people you are treated the same as if you were a Japanese registered company. Again, we are not Japan tax experts and we have no legal qualifications in tax; however, from several conversations with agencies who deal with tax in Japan this is the advice they give (2, 5) :

If sales are below 10 Million Yen (approximately £68,000 or $88,000

Once you reach the 10 Million Yen level you will need to seek professional tax advice (5).

2022 Update

The Japanese tax authorities have changed the process for how they tax overseas businesses who sell via e-commerce platforms in Japan.

Many overseas businesses who sell online in Japan were not paying taxes properly and Japan has been missing out on sales tax revenue from overseas businesses. They have closed that gap and introduced a new system to deal with Foreign Onlines Sellers.

In the past, an overseas business paid consumption tax ( equivalent of US sales tax or EU VAT) and import duties based on the bill of lading only.

But now it’s different.

When you import goods into Japan to sell online you now have to declare your sale price.

For Amazon specifically, The tax authorities charge you consumption tax on the retail value minus Amazon’s costs. (Pick & Pack fee + referral fee commission).

Example

| Manufacturing Cost per Item | Sale Price | No. of units imported | Shipping Cost | Amazon’s fees per product sold |

Duty (4%) |

Consumption Tax (10%) | Total | Equivalent rate paid of Retail value | |

| Old System (2019): | $10 | $40 | 1,000 | $3,000 | $7.00 | $520 | $1,000 | $1,520 | 2.50% |

| New System (2022): | $10 | $40 | 1,000 | $3,000 | $7.00 | $520 | $3,300 | $3,820 | 8.25% |

https://docs.google.com/spreadsheets/d/1NfeDT93iz-MFXNlHMn4PIX3BEMVd-MNLC5TjXTfQomM/

Summary

It depends on your costs, but if you calculate a tax fee of around 8% of your retail value then your estimate should be about right.

Thinking of declaring a cheap sale price on Amazon and then put it up when they arrive?

The tax authorities are checking Amazon listings regularly. If they uncover that you are trying to deceive them, then you may have trouble with future imports.

For overseas sellers, it’s disappointing that costs have increased. But it’s a fairer system with both domestic and foreign sellers now paying roughly the same amount of tax.

The import process in detail

When your products arrive at customs you have to fill in a spreadsheet containing the following fields:

- Product Name

- Category

- Quantity

- HS Code

- AMazon ASIN

- Amazon Sale price

- Amazon Product Page Link

- Amazon FBA Pick & Pack Fee

- Amazon Commission

- Revenue per item

- Total Revenue

- Hazardous Material?

Here is an Example:

In addition to filling the spreadsheet customs usually ask for confirmation of AMazon’s fees. They want to see screenshots of the FBA Fee simulator page like this:

Once the goods clear customs you get an invoice in Japanese which your importer pays on your behalf. You then pay them once the fee is confirmed.

Here is such an invoice with confidential details erased:

Summary of Taxes for Overseas Amazon Japan Sellers

Taxes are confusing at the best of times, never mind when you are selling in a foreign country where you cannot understand the language and have no experience in sales.

In this article, we have covered the important aspects when it comes to overseas sellers on Amazon Japan. We are not tax agents or legal advisers;

The conclusion is:

- If you self-fulfil from outside of Japan you don’t pay taxes if the product value is under ¥10,000

- If you self-fulfil from outside of Japan and the product is worth over ¥10,000 the customer will pay taxes when it arrives.

- If using FBA you will pay at the point of import unless you file for taxes through and official route in Japan and use a Japanese accountant.

References & Useful Links

1. www.exporttojapan.co.uk

2. www.ebiz-japan.com/

3. www.eubusinessinjapan.eu

4. www.j-wire.info/

5. eu-japan.eu/

6. www.bluewheele.com

7. www.jetro.go.jp/en/

8. www.customs.go.jp/english/summary/import.htm

9. www.customs.go.jp/english/summary/tariff.htm#Other_Internal_Taxes

10. www.customs.go.jp/english/summary/tariff.htm

11. www.gov.uk/topic/business-tax/vat

12. www.parcelhero.com/blog/expert-shipping-advice/guide-sending-parcel-japan

13. www.customs.go.jp/english/c-answer_e/imtsukan/1204_e.htm

14. www.nta.go.jp/taxanswer/shohi/6101.htm

15. services.amazon.com/global-selling/taxes-regulations.html

16. www.gov.uk/government/world-location-news/how-to-sell-through-amazon-japan

17. services.amazon.co.jp/services/out-of-country/en/local-laws.html

18. www.eubusinessinjapan.eu/issues/financial-issues/taxes-accounting/consumption-taxes/consumption-tax

19. www.eubusinessinjapan.eu/issues/financial-issues/taxes-accounting/consumption-taxes/foreign-business-and-consumption-tax

20. mywifequitherjob.com/how-to-sell-on-amazon-in-the-uk-canada-europe-japan/

21. ecommdo.com/podcast-04/

22. www.jetro.go.jp/en/invest/setting_up/laws/section3/page6.html

23. blog.gaijinpot.com/consumption-tax-increase-japan/

24. japanconsult.com/taxes-in-japan-for-corporations/

25. www.nta.go.jp/foreign_language/consumption_tax/04.htm

WE SPECIALIZE IN:

- Amazon Japan Listing Creation & Optimizations

- Amazon Japan Advertising

Our goal is to help brands launch and grow sales on Amazon Japan.

PRICING SUMMARY

We want to make our pricing as clear and simple as possible, which is why we have fixed fees rather than complex commission based pricing or contact us for a quote links.

NEW LISTING SETUP OR OPTIMIZATION

$449 per product type + $30 for any additional variation

UNBOXING/ EXPLAINER VIDEO/ VOICE-OVER VIDEOS

$199 per video

ACCOUNT & ADVERTISING MANAGEMENT

From just $799/month or 5% of revenue

AMAZON JAPAN LISTINGS

LISTING CREATION / OPTIMIZATION PRICING

$449 per product type (Parent ASIN) + $30 for any additional variation (Child ASIN)

EXAMPLE PRICING CALCULATION

10 x product types with each product type having 3 colour variations.

- 30 products in total, 20 of which are classed as Child variations and 10 are classed as Parents

- (10 x $449) + (20 x $30) = $5090

Having a well written and keyword rich product listing is essential because:

- Shoppers need to be able to find your product on Amazon Japan.

- When they do find you product they then need to have confidence so they buy.

See a finished result for one of our clients on Amazon Japan - https://www.amazon.co.jp/dp/product/B08RS5MKW5

This was quite a complex project with a lot of size and type child variations. But the effort was definitely worth it.

The Rising Sun Commerce Amazon Japan Product Listing Process:

We gather all the information needed to fully understand your product and brand. We need to understand your products' features and benefits in fine detail so that we can hone the copy of your listing. We can use your English Amazon listings as a guide, however Amazon Japan is VERY strict in the wording you can use and often your English listings would be rejected instantly.

2.

We conduct detailed keyword research using specialist software such as Helium10’s Cerebro tool to analyze the keywords used by your main competitors on Amazon Japan. We also use Amazon’s own Brand Analytics data to ensure we pull out all of the most important keywords. Finally, we manually read over your competitors listings to pick out common keywords.

3.

Our optimally written product listings are professionally translated by one of Rising Sun Commerce’s experienced native Japanese listing editors who carefully integrate the keywords from the extensive keyword research process as they translate your product listings - check out Shiori’s short video where she discusses a client's listing here.

4.

We annotate any text in your images into Japanese, because everyone knows that the images are one of the most important aspects of your Amazon Product Detail Page.

5.

We construct an upload (AKA flat) file and upload your listings to Amazon Japan. We complete as many fields as possible in the flat file to help with Amazon indexing and categorisation. We apply any keywords that are not integrated into the product listing into the Generic Search Terms (AKA back end search terms). Uploading the flat files to your Amazon Japan account can sometimes be a smooth process, but due to Japan’s quirks and glitches this can often be a bumpy process. We guarantee that your product listings will be uploaded to Amazon Japan, even if it takes multiple Seller Support cases and multiple revisions to remove and replace text or images to satisfy the Amazon Japan gods.

6.

We upload your Japanese specific images to Amazon Japan. This can be a complex process and often requires multiple attempts and Seller Support cases. It also requires Brand Registry access so there is additional admin required.

7.

Any appropriate listing videos will be annotated and/ or a voice over will be applied at no extra cost. The videos will be uploaded to your listings.

8.

Using your English A+ content as a guide we construct and upload A+ content for your product listings. Like the Product Detail Pages this can often be a tough process because Amazon Japan are irrationally picky about the words you can use. We have a database of banned words and phrases, but we are still surprised by Amazon when they pick up on a new term. Again, we guarantee your A+ content will be uploaded to Amazon Japan, no matter how long it takes.

9.

Finally, once the listing has been on Amazon Japan for a few days we do Keyword Index Checks to make sure the listings are correctly indexed.

The video below show how we make sure your products are fully indexed on Amazon Japan.

JAPANESE UNBOXING & VOICE-OVER VIDEOS

Using one of our trusted native Japanese creators we can commission custom unboxing videos for your products.

We ensure the creators discuss the main benefits and features of your product.

Alternatively, if you have a good promotional video in English, we can replace the English voice with a professional standard Japanese voice.

Having a video on your Amazon Japan product listing is a major benefit and helps show the shopper exactly what they will get and reinforces the main product selling points.

$199 per video